Circumstances Under Which Marginal Costing Technique Is Used

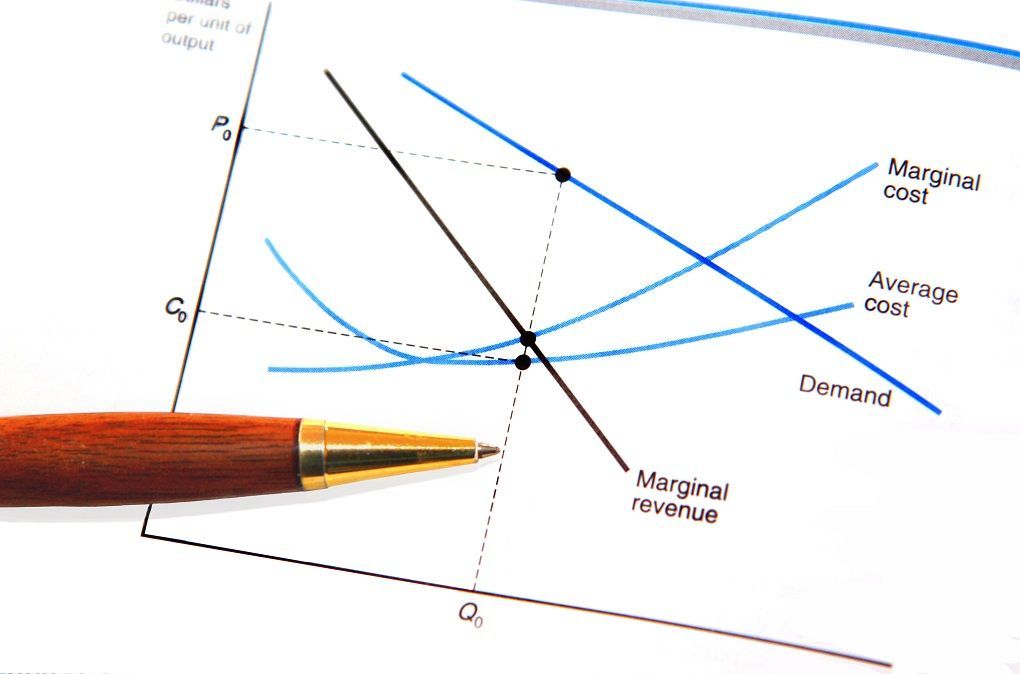

It is a technique of costing which is used to ascertain the marginal cost and to know the impact of variable cost on the volume of output. It is a technique of costing which is used to ascertain the marginal cost and to know the impact of variable cost on the volume of output.

Managerial Costs Ag Decision Maker

I Fixation of Selling Price.

:max_bytes(150000):strip_icc()/dotdash-INV-final-Absorption-Costing-May-2021-01-bcb4092dc6044f51b926837f0a9086a6.jpg)

. Fixation of selling price. It relates to the change in output in the particular circumstances under consideration. Managerial Uses of Marginal Costing.

Any decision which involves consideration of variable cost and revenue requires application use of marginal costing. However fluctuations in variable cost in different production capacities are known as the marginal cost for the company. This difference in profits is due to use of different inventory valuation methods under both techniques.

Even semi fixed cost is segregated into fixed and variable cost. First of all the marginal costing techniques MCT are used by management accountant to present cost information which will be used for decision making. Marginal costing can be used to assist in decision making in the following circumstances.

The following may be listed as specific managerial uses. The term marginal cost implies the additional cost involved in producing an extra unit of output which can be reckoned by total. The marginal costing technique is used to analyses and interprets the cost data for the purpose of identifying the profitability of product process department or cost centre.

Marginal costing is a very useful technique of decision-making for management. Some of the important decisions taken with the help of marginal costing technique are. Variable cost is charged to units of cost while the fixed cost for the period is completely written off against the contribution.

All costs are classified into fixed and variable cost on the basis of variability. Contribution is the difference between sales value and variable cost. Ascertainment of marginal costs.

Marginal Costing is a costing technique wherein the marginal cost ie. Fixed costs are treated as period costs and written off in full against contribution under marginal costing. Under Marginal Costing technique only variable costs are charged to cost units the fixed.

Marginal costing technique facilitates not only the recording of costs but their reporting also. Thus all expenses are classified under two. Nature of Marginal Costing.

The classification of costs into fixed and variable components makes the job of cost ascertainment easier. The key reason for this is that the marginal costingapproach allows managements attention to be focussed on the changeswhich result from the decision under consideration. It can therefore be used in conjunction with the different methods of costing such as job costing.

Acceptance of a special order dropping a product make or buy decision and to choose which product mix to produce when a limiting factor resource exists. It is a technique of costing in which allocation of expenditure to production is restricted to those expenses which arise as a result of production ie direct materials direct labour direct variable expenses and variable overheads. Ii Decision relating to the most Profitable Product Mix.

In Marginal Costing we study the impact of variable cost at distinctive levels of production capacity for that we need to divide the total cost into fixed and variable cost because the fixed cost does not make any impact on marginal cost. Marginal costing is a technique of ascertaining cost used in any method of costing. Marginal cost per unit remains unchanged irrespective of the level of activity or output.

The technique of marginal costing involves. Techniques of Marginal Costing. Ascertaining the effect on profit due to changes in volume or type of output ie the determination of cost-volume-profit relationship.

In marginal costing inventories are values at marginal cost of production but in absorption costing they are valued at total production cost which causes different profit figures in both techniques. According to this technique variable costs are charged to cost units and the fixed cost attributable to the relevant period is written off in full against the contribution for that period. Marginal costing is a management technique which is used to add variable production overheads into the cost of a product.

Nature of Marginal Costing. Marginal cost is the sum total of direct material cost direct labour cost variable direct expenses and all variable overheads. The major characteristics of MCT are the separation of the total cost into its variable and fixed components.

Marginal costing doesnt take fixed costs into account under product costing or inventory valuation Inventory Valuation Inventory Valuation Methods refers to the methodology LIFO FIFO or a weighted average used to value the companys inventories which has an impact on the cost of goods sold as well as ending inventory and thus has a financial impact on the companys. The contribution concept lies at the heart of marginal costing. Being a technique marginal costing is not used independently and can be used along with any method of costing such as Job Costing Process Costing and the like.

Marginal Cost means Variable Cost. Marginal costing is also the principal costing technique used indecision making. Differentiation between fixed costs and variable costs.

Prime CostTotal Direct Cost Direct Labor Direct Material Direct Expenses. Marginal costing is used to provide a basis for the interpretation of cost data to measure the profitability of different products processes and cost centres in the course of decision making. A Under normal circumstances b For special market export or for a special customer c During recession d At marginal cost or below marginal cost.

Some of the important decision making areas where marginal costing technique is used are.

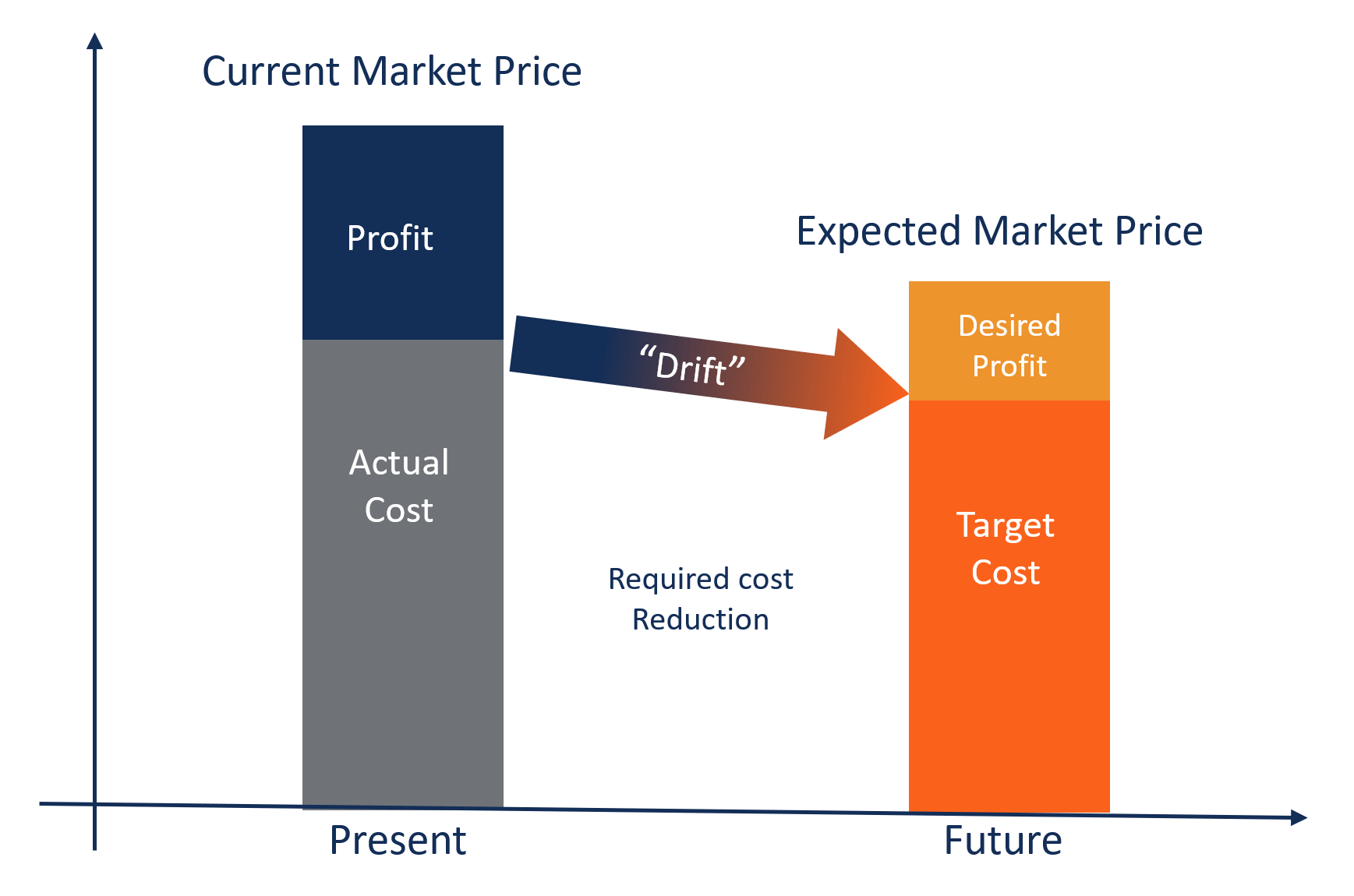

Target Costing Key Features Advantages And Examples

How To Calculate Marginal Cost Gocardless

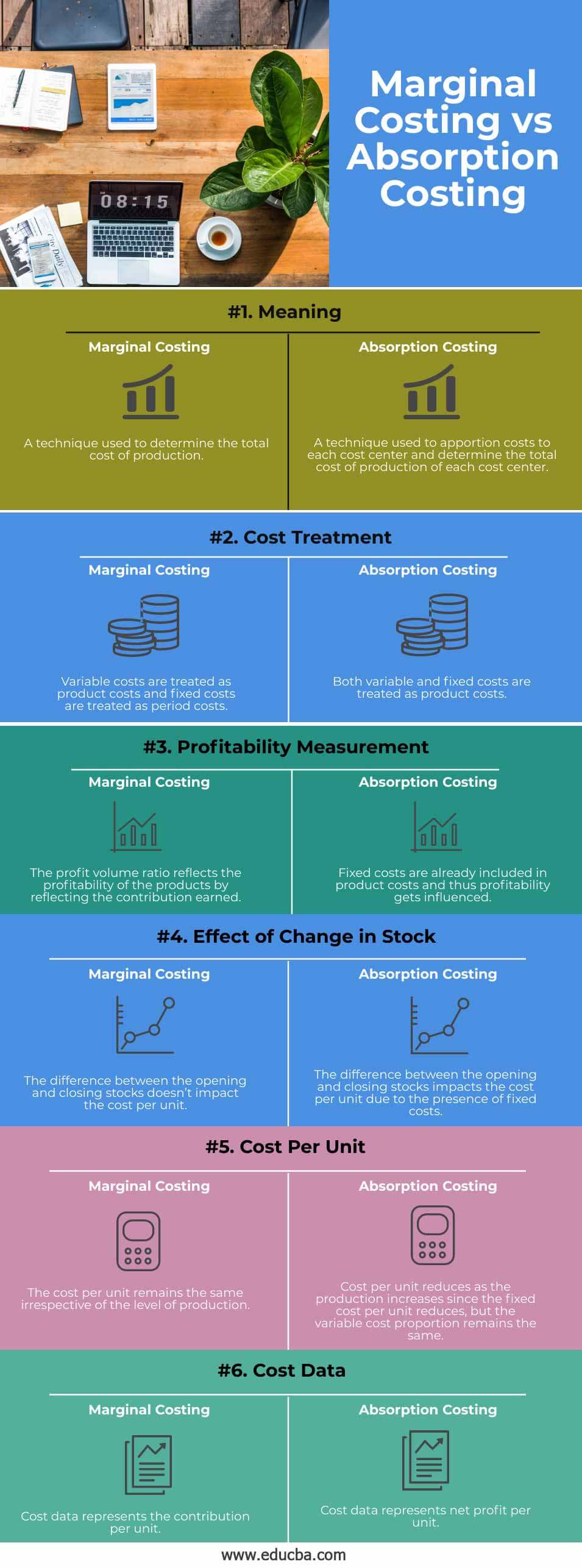

Marginal Costing Vs Absorption Costing Top 6 Differences To Learn

Affinity Diagram Template Mind Map Template Brainstorming Methods Templates

Economic Concepts Concept Of Economics Economics Economics Lessons

/businesswomen-having-meeting-with-laptops-in-boardroom-1128219622-9d4f54e636a94371853ab42205bd9220.jpg)

How Does Marginal Analysis Help In Managerial Decisions

A Phase Diagram In Physical Chemistry Engineering Mineralogy And Materials Science Is A Type Of Chart Used To Show Condi Physical Chemistry Diagram Graphing

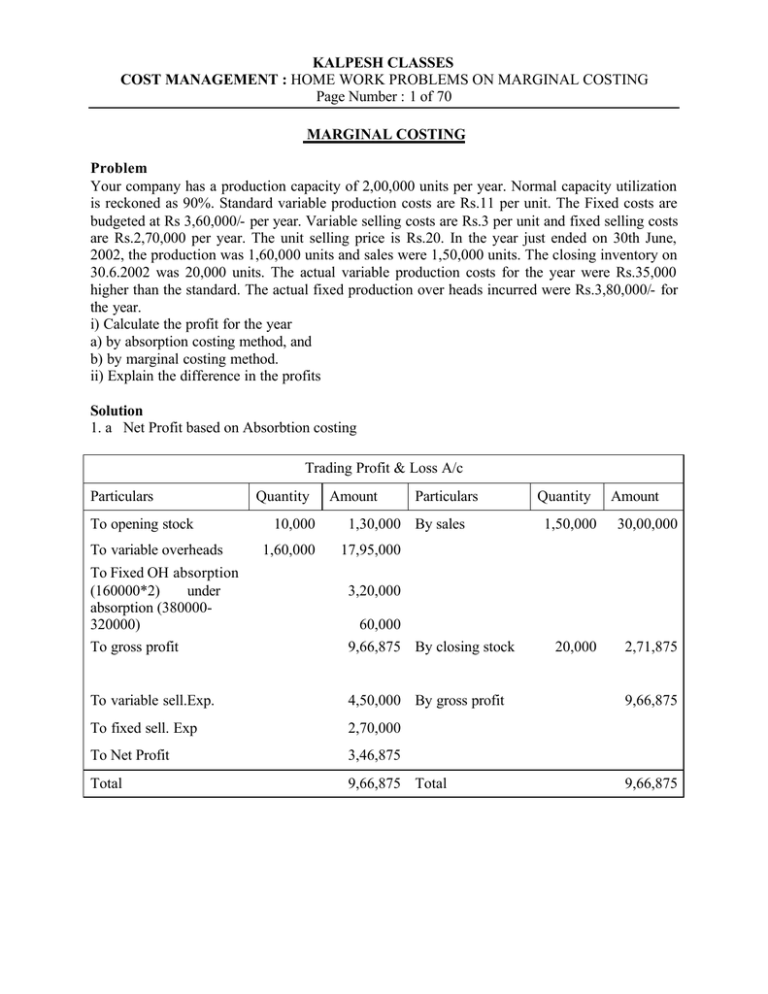

Kalpesh Classes Cost Management Marginal Costing

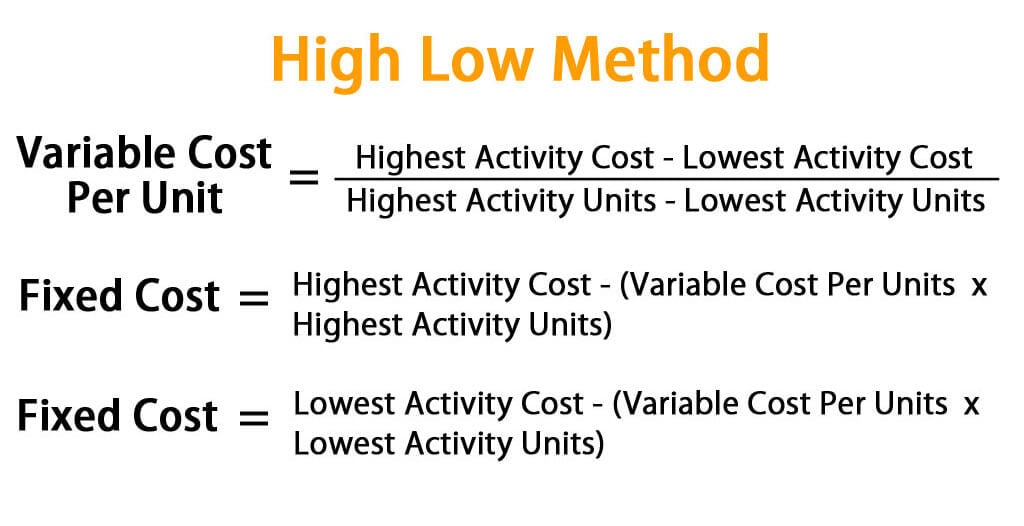

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Download The Specifications For Reinforcement Steel Best Online Engineering Resource Reinforcement Steel Steel Bar

Managerial Costs Ag Decision Maker

Marginal Cost Definition Formula And 3 Examples Boycewire

Variable Costing Vs Absorption Costing Top 8 Differences Infographics

Marginal Analysis Overview Uses And Rules Limitations

Economic Concepts Concept Of Economics Economics Economics Lessons

Difference Between Absorption Costing And Marginal Costing Difference Between

/dotdash-INV-final-Absorption-Costing-May-2021-01-bcb4092dc6044f51b926837f0a9086a6.jpg)

Comments

Post a Comment